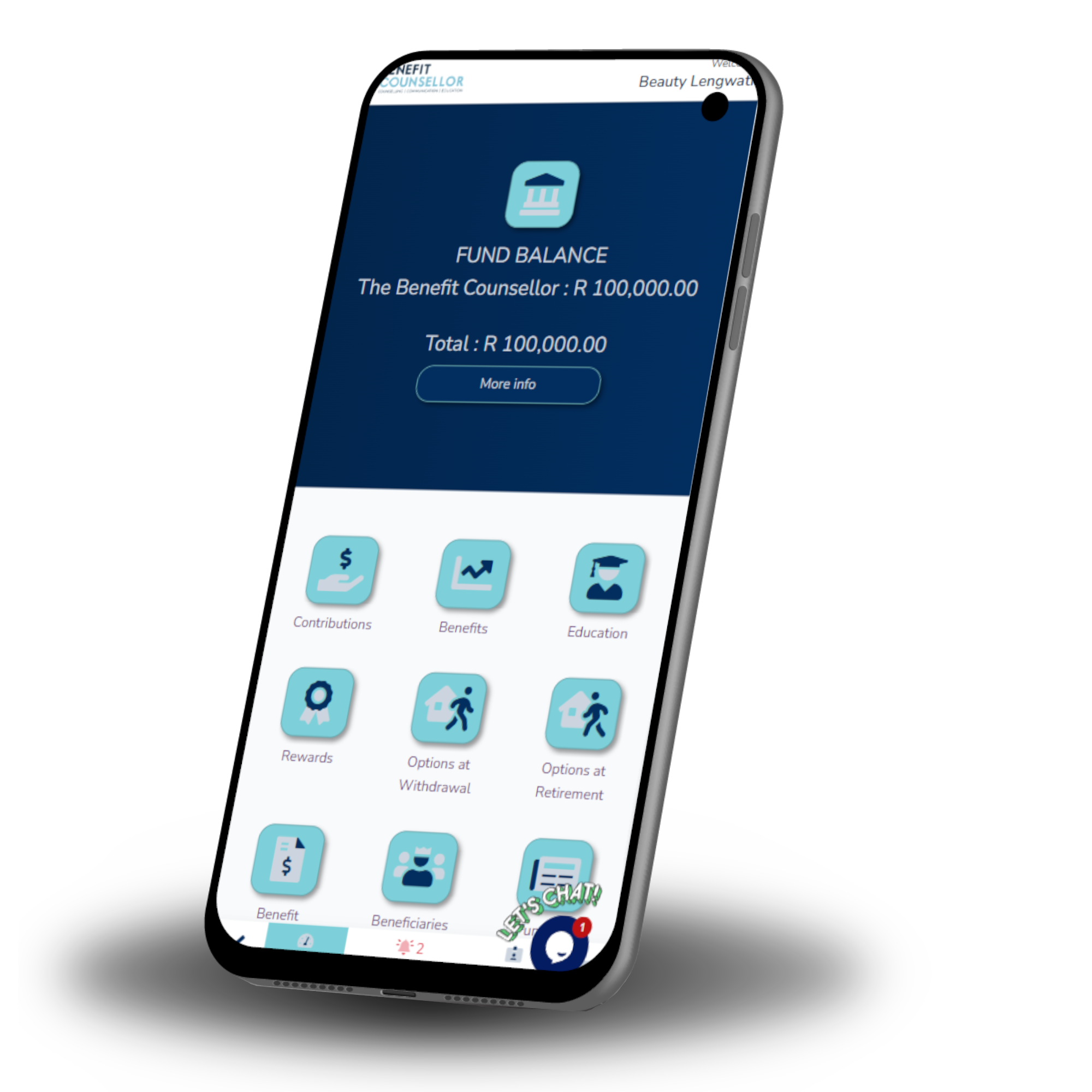

The Benefit Counsellor is a member engagement platform for retirement funds that want to engage, educate and empower their members.

1 September 2024 the new Two Pot System comes into effect, is your fund ready?

Most trustees and funds have made adjustments for assets, admin and rules. Have you thought of how to handle the member claims under the new system?

Benefit Counsellor has a integrated claims process that verifies the identity and details of the claim before it get to your admin system and team.

Our 2-pot claims workflow will save you time, money and provide the members with a great experience!

400,000

Retirement fund members helped.

9

Retirement fund clients.

14 Million

WhatsApp messages per year.

Other Services

Retirement Benefits Counselling

Mobile-first approach for the modern user.

Access via any device with a web connection.

Private, safe and secure.

Independent of any product provider.

Streamlined and modern paperless exit process.

Member Communication

Access digital benefit statements.

Seamless WhatsApp intergration.

Online live chat assistance.

Efficient customer experience with Chat Bots.

Email support and concerns functionality.

Mobile access to information with USSD Channels.

Focus on user experience by removing unnecessary barriers.

Member Education

Fund specific approach to educating members.

Holistic financial wellness calculators.

Measuring member engagement and understanding of educational content.

Direct member behaviour with gamified rewards.

Keep your members informed with engaging content.

Clients

In The Media

Digital adoption in the retirement industry during lockdown

by Ernst Hertzog | EBNet 29 April 2020

Lockdown has had a major impact on how people live, work and communicate. While most people are focused on food security and when they will be going back to work, life will never be the same for most industries.

Retirement Benefit Counselling and the Digital Era

by Hayden Naidoo | June 2020

Recent events, such as the Covid-19 pandemic, have shown companies across the globe the importance of flexibility and adaptation. The ability to conduct business remotely can be a matter of life or death for certain businesses.

How WhatsApp can bring much-needed change to the Retirement Industry

by Hayden Naidoo | June 2020

Most retirement funds in South Africa still rely on the South African Post Office to fulfill their obligations to communicate with members especially when it is time to distribute benefit statements.

Contact Details

Tel no.

+27 21 300 5729

Address

Head Office

Unit 1.1

On The Greens Office, Golf Village

De Beers Ave

Somerset West

7129

Johannesburg: Satellite Office

Get In Touch

Copyright © The Benefit Counsellor (Pty) Ltd 2026